In Lagos’s competitive luxury real estate market, two names consistently dominate the conversation: Ikoyi on the Island and Ikeja GRA on the Mainland. For the serious investor or high-net-worth (HNW) homeowner, the choice is not simply about location, it’s a critical financial decision about where to put capital for the best long-term return on investment (ROI).

This real estate investment guide breaks down the comparative advantages of both locations, focusing on the key metrics of Value and Stability, to help you make a strategic and informed investment choice. We will move beyond the reputation and analyze the hard numbers, infrastructure, and market dynamics that truly determine which luxury location offers the superior long-term advantage and profitability.

ATTENTION: If you are looking to buy a land or house in Ikeja or Ikoyi, Kindly send a message below to get started.

Ikeja vs. Ikoyi 2026 (The Core Difference: Prestige vs. Practicality)

To understand the investment landscape, one must first grasp the identity of each locale.

Ikoyi: The Epitome of Exclusive Legacy

Ikoyi is Nigeria’s long-established symbol of ultra-luxury. It is synonymous with exclusivity, high-net-worth individuals, diplomats, and senior executives.

-

Identity: Lagos’s Beverly Hills or private, serene, secluded, and built for exclusivity.

-

Infrastructure: Superior road quality, excellent, flood-resistant drainage systems, and generally more stable power supply with common backup systems.

-

Investment Focus: Wealth preservation, strong capital appreciation, and prestige.

Ikeja (GRA): Premium Mainland Value

Ikeja is the capital of Lagos State and a central hub for commercial, corporate, and government activity. While Ikoyi offers generational prestige, Ikeja GRA (Government Reserved Area) is the highest-end segment of the Mainland, combining premium residential appeal with strategic corporate presence.

-

Identity: Premium mainland location with high-quality infrastructure, strong commercial activity, and exclusive residential appeal.

-

Investment Focus: Corporate tenants, proximity to the airport, high rental demand, and a balanced return profile.

Ikeja vs. Ikoyi 2026 (Comparative Value: Where You Will Get More for Your Money)

The concept of “value” in real estate is a function of initial capital versus future return.

Capital Outlay and Entry Cost

Ikoyi properties command significantly higher prices across the board, reflecting its status and scarcity of land.

-

Ikoyi: The median house price in Ikoyi has been estimated at around ₦1.2 billion, approximately double that of similar high-end areas on the Island. Entry-level properties typically start around ₦400 million to ₦600 million.

-

Ikeja: While prices are also premium, the Mainland offers greater affordability and value. Prime mainland properties, which include Ikeja GRA, average in a lower price per square meter range compared to the Island. This translates to a more accessible entry point for investors seeking luxury.

The cost of living and maintenance also factor into the total value proposition. Ikoyi can command higher annual maintenance and service fees, ranging from ₦800,000 to ₦3,000,000, compared to a range of ₦500,000 to ₦2,000,000 in Victoria Island/Mainland equivalents.

Ikeja GRA vs Ikoyi Rental Yield Comparison

For investors whose goal is consistent cash flow, rental yield is the ultimate metric.

| Area | Property Type | Gross Yield (Approx.) | Net Yield (Approx.) | Key Factor |

| Ikoyi | 1-2 bed apartments | 4.5% – 6% | 3% – 4.5% | Premium location, high purchase price leads to lower yield. |

| Ikeja | Family units/ Corporate apartments | 6% – 8% | 5% – 6.5% | Strong corporate/family tenants, proximity to airport, balanced purchase price. |

The Verdict on Yield: Ikoyi’s ultra-high purchase prices often result in lower rental yields, sometimes as low as 3-4% for ultra-luxury properties. Ikeja, however, often achieves superior gross and net yields (6-8%). This is because the rents are strong, driven by corporate and diplomatic demand, but the initial purchase price is proportionally lower than Ikoyi’s top-tier market. For cash flow investors, Ikeja GRA offers superior rental value and return on investment.

ATTENTION: If you are looking to buy a land or house in Ikeja or Ikoyi, Kindly send a message below to get started.

Assessing Long-Term Stability and Risk

Stability is not just about security; it encompasses market maturity, infrastructure reliability, and capital appreciation rates.

Ikeja GRA vs Ikoyi Investment Risk Analysis

Both Ikeja GRA and Ikoyi are considered low-risk compared to emerging areas of Lagos, but their risk profiles differ based on market maturity and liquidity.

-

Ikoyi Risk Profile: The main risks in Ikoyi are low liquidity in the ultra-luxury segment and exposure to economic shifts that affect high-net-worth individuals and expatriate tenancies. However, Ikoyi is viewed as a true hedge against inflation in Nigeria, with property value consistently gaining as the Naira depreciates. The stability is derived from exclusivity and superior infrastructure.

-

Ikeja Risk Profile: Ikeja GRA’s risks are more related to mainland infrastructure variability outside the GRA and potentially slower capital appreciation compared to the hyper-growth of new suburbs. However, its stability comes from its position as a government and commercial center, ensuring consistent demand from corporate and government executives.

It can be said that Ikoyi offers stability through prestige and wealth preservation, while Ikeja offers stability through consistent corporate demand and essential business proximity.

Spotlight on Opportunity: Awolowo Way, Ikeja

When discussing high-value pockets within Ikeja, the Government Reserved Area (GRA) is paramount. It is one of the most exclusive residential areas on the Mainland, home to high-ranking officials and large, beautifully structured properties.

This strategic location is where the term Awolowo Way Ikeja property appreciation rate becomes key for savvy investors. Awolowo Way is a premium corridor within Ikeja GRA, characterized by a mix of high-end commercial activities, government presence, and luxurious residential developments.

Investing in this specific corridor means capitalizing on:

-

Guaranteed Infrastructure: As a primary government and corporate zone, infrastructure maintenance is prioritized, directly supporting long-term property values.

-

Corporate Tenant Base: The area attracts corporate head tenants willing to pay a premium, which keeps rental yields high and vacancy rates low.

-

Future Growth Potential: With the Island becoming increasingly saturated and expensive, the demand for well-maintained, strategically located Mainland premium assets like those on Awolowo Way is projected to see steady and robust appreciation, complementing its already strong rental income.

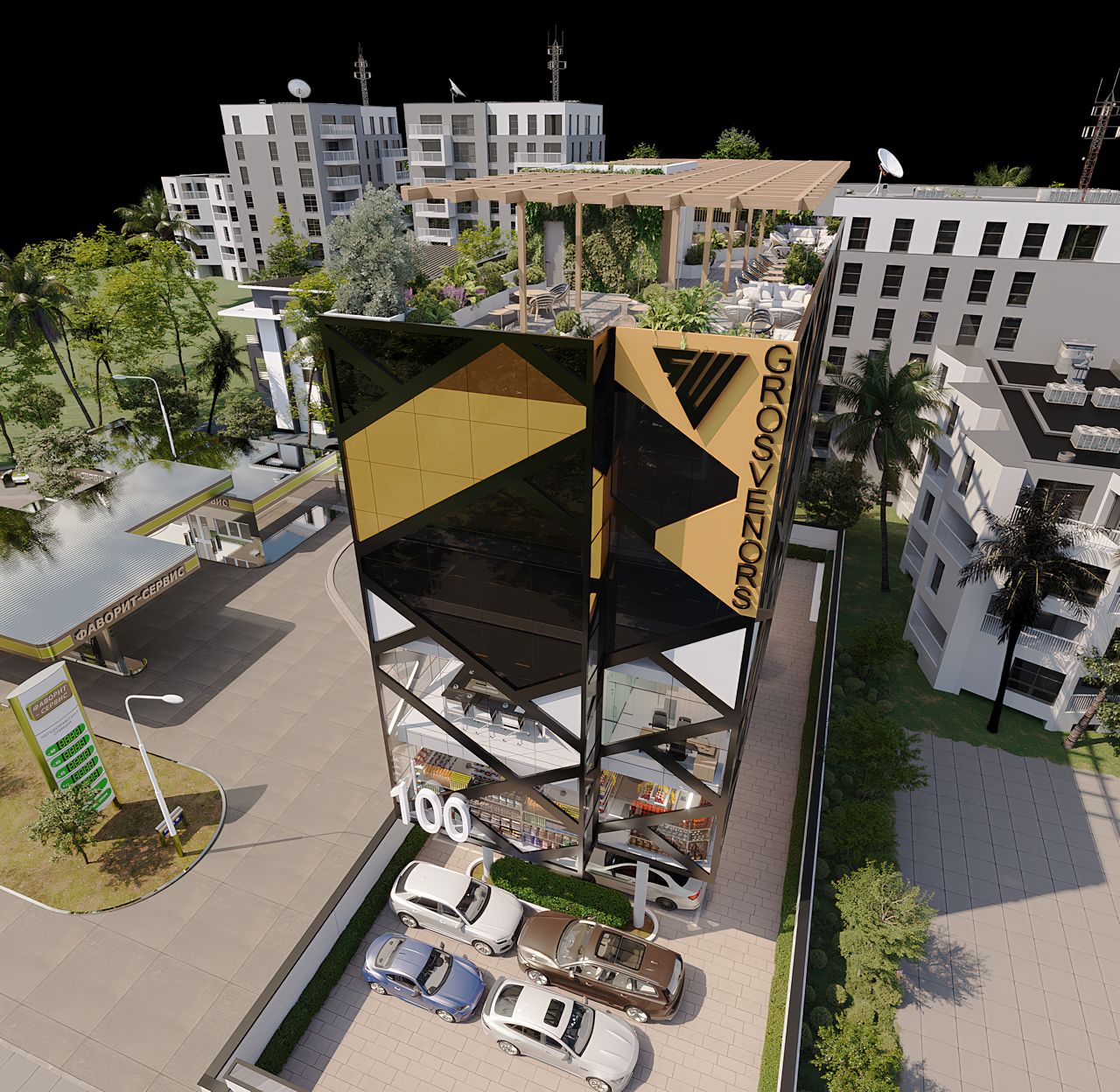

A perfect example of an investment capitalizing on this blend of premium location and strong financial metrics is Grosvenors Place, Awolowo Way, Ikeja. Located directly in the high-value Ikeja GRA corridor, this development offers the stability and returns that serious investors seek on the Mainland.

You can find more details on this prime investment opportunity here: Grosvenors Place, Awolowo Way, Ikeja

Conclusion

The “better” luxury location ultimately depends on your investment goal:

-

Choose Ikoyi If: Your primary goal is wealth preservation, status, ultra-luxury living, and maximizing capital appreciation over decades, even if it means accepting a lower rental yield.

-

Choose Ikeja (GRA) If: Your primary goal is superior value, a high and consistent rental yield, proximity to the commercial heart of the Mainland, and a strong balance of capital growth and cash flow.

While Ikoyi boasts the prestige, Ikeja GRA, particularly the Awolowo Way corridor, offers the demonstrably better combination of value and high rental returns for the financially-minded investor today. It provides the practical stability of a long-established government and business hub while delivering a better price-to-rent ratio, making it the strategic choice for those focused on comparative financial advantage.

ATTENTION: If you are looking to buy a land or house in Ikeja or Ikoyi, Kindly send a message below to get started.